16 Aug 2021 AutoIntelligence | Strategic Report

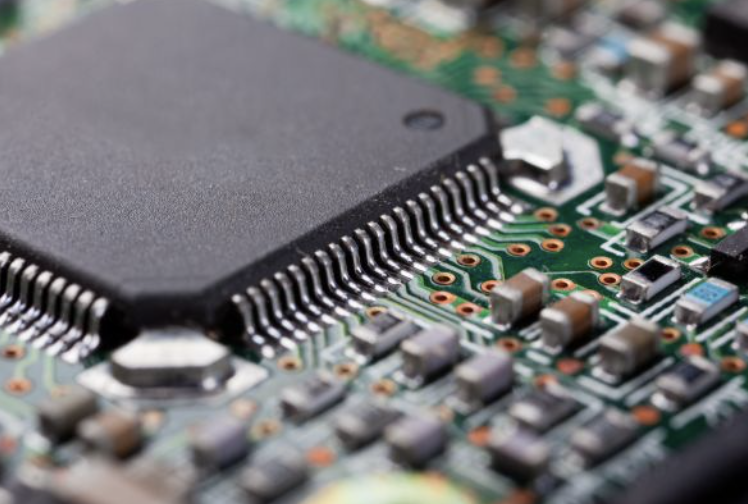

Reports of disruption within the supply chain of semiconductors to the automotive sector began in late 2020 and is now continuing into the third quarter of 2021. Pressure built up as the automotive industry recovery from the widespread coronavirus disease 2019 (COVID-19) virus pandemic-related lockdowns experienced during the first half of 2020 clashed with increasing demand from the wider consumer electronics sector, itself recovering strongly and, late in the year, building stocks for the holiday season. The situation has been further exacerbated by other factors, including the fire at Renesas’ Naka (Japan) facility on 19 March, which only reopened fully in late June, and following the severe weather that hit the southwest US in February. Other factors have also come into play more recently, such as lockdown measures in Malaysia.

Many OEMs have been affected by this situation and will continue to be so. Here is a selection of key automakers that have been hit, the steps they have taken to mitigate the situation and their expectations for the remainder of the year.

Ford has been hit heavily by the shortage at its sites both in North America and in Europe. In North America, multi-week stoppages took place in the first quarter of the year, and these spread across more sites in the second quarter. Many sites continue to be hit by disruptions during the third quarter. This affects production of such important models as the Explorer; the new Bronco Sport and Bronco; and the F-Series and Ranger pick-ups.

All the automaker’s sites in Western and Central Europe were affected by multi-week stoppages during the first half of the year. This hit production of models such as the sub-compact crossover built in Craiova (Romania); the Transit and Transit Custom built in Kocaeli-Otosan (Turkey); and Kuga and Transit Connect manufactured at Valencia (Spain), with the latter site already planning more stoppages in the third quarter. Ford’s German sites in Saarlouis, which builds the Focus, and Cologne, which manufactures the Fiesta, are also seeing the third consecutive quarter of disruption caused by the semiconductor shortage.

There have also been several stoppages in Asia, taking in operations in China, India and Thailand since the beginning of the 2021. China is the only market not expected to be hit by more stoppages in the third quarter.

During the announcement of its second-quarter financial results during late July, Ford said that its wholesales dropped compared to the first quarter due to the semiconductor shortage, which is causing a drop in its inventory. However, CEO Jim Farley said of the situation in North America that it is aggressively encouraging customers to order vehicles supported by the introduction of a simplified ordering process. He noted that the company has orders for 70,000 units on its books, and that customer orders will be something the company looks to develop in future, for better visibility on customer demand and more-efficient operations. Despite the ongoing semiconductor issue, the company returned a profitable quarter as well. In Europe, it has shifted its focus on to LCVs and discontinuing low-margin products. Looking forward, Ford executives state that the company expects its results in the third quarter to be weaker than in the second quarter. After its exposure to the Renesas situation it is taking steps to adjust the way it deals with its suppliers in such circumstances in future. Although there are signs that the semiconductor shortage situation is improving, Ford says the shortage could extend into 2022.

GM's production has been affected across its operations in North America, South America and Asia as a result of the semiconductor shortage. Multi-week stoppages have occurred and have continued at some locations in the North America, a situation that is now into its third quarter. Despite attempts to avoid experiencing impact to some of its highest margin products like its full-size pick-up trucks and sport-utility vehicles (SUVs), most notably the Cadillac Escalade, disruptions have started hitting these products mainly in the third quarter.

There are also significant ongoing disruptions at its Brazilian operations, with the Gravatai (Brazil) facility in the middle of a stoppage that will have lasted for around five months when production resumes at an initially slower pace in August. Production at the São Caetano do Sul plant has stopped for a time in the third quarter, coinciding with changes related to the launch of a new vehicle in 2022. Elsewhere, its two sites in South Korea had output reduced at various times during the first two quarters, and more reductions have been announced for the third quarter. In China, there were limited disruptions to production at its SAIC-GM joint venture (JV) in the second quarter, with plants planning more stoppages in the third quarter.

During the announcement of its second-quarter 2021 financial results, General Motors (GM) said that its performance has been better than its initial guidance despite the shortage, on the back of strong pricing and demand. For the full year, the company now expects the semiconductor shortage to remain fluid and expects to see other supply-chain issues into the second half of 2022. It has added that it expects to have no ‘build-shy’ or work-in-progress inventory at the end of the year, but states that significant cash flows could shift from the second half of 2021 into 2022, if it ends up with significant numbers of work-in-progress vehicles at year-end. Included in its renewed guidance for 2021 is an expectation of a reduction in its GM North America production of 100,000 units in the second half of 2021.

All the partners of the Renault-Nissan-Mitsubishi Alliance have been affected by the shortage of semiconductors to some degree. The Renault Group’s operations in Europe have been affected in Spain especially, with downtime in the first half of the year, and it has already implemented stoppages in the third quarter, including the extension of the summer shutdown. It has now agreed with unions to extend a period of temporary redundancy until the end of the year. Its LCVs and BEVs have been among the models affected at its domestic French sites, while those in Central Europe have included its low-cost Dacia brand focused on Pitesti (Romania). Stoppages at its site Bursa (Turkey) facility will now roll over into the third quarter. A more modest impact has been felt at some of its other sites around the world.

Nissan has been seeing challenges at some of its Japanese sites. This had primarily focused on the second quarter of the year, with some downtime or reduction in output being implemented. However, volume impact is now being seen in the third quarter. North America has adjusted production, focusing on the second quarter; production of the Infiniti QX50 has been hit especially hard with no production in June. However, some sites are now planning to stop in the third quarter. Locations in other regions have also been, and will be, hit by reductions, including Thailand.

Mitsubishi is also managing output of its kei-cars and crossovers in Japan, as well as models built at its sites in Thailand and Indonesia. Further disruption is occurring in the third quarter, with the impact so far less damaging than in the second quarter but increasing.

In early July, Renault Group’s CEO Luca de Meo warned that the semiconductor shortage will continue to have an impact on its business into 2022. The senior executive was quoted as saying that its suppliers have warned that it is, “A structural thing that will be with us through 2022... There will be tension in the system even if production capacity is improving.” He went on to say, "We have managed in the first half, but of course we have lost volumes," and that the industry is still struggling with visibility on supplies, which “changes every week.” During the announcement of its first-half financial results, the company has suggested production losses could reach 200,000 units during 2021.

When Nissan announced its first-quarter fiscal year (FY) 2021/22 financial results during late July 2021, it said that it had managed the worst effects through inventory management and conducting strategic management. However, it added that it expects the shortage to have a significant impact on its sales volumes in the second quarter. Nissan expects the issue to continue and the shortage to affect about 500,000 units of output this year. However, it aims to recover about half of the lost output in the second half of the FY when the chip shortage is expected to ease.

Stellantis' operations in North America have undergone some significant disruptions caused by the semiconductor shortage, which caused a fall in shipments in the region during the first quarter. The majority of sites have suffered and continue to be hit by multi-week production stoppages, including 23 weeks at the Toluca (Mexico) plant, which builds the Jeep Compass, across the first three quarters of the year, with this ongoing until the end of July (also coinciding with production of a mid-cycle update). Other sites have avoided or managed to minimise the impact suffered, especially for new and profitable vehicles. These include the Saltillo Truck (Mexico) site, which mainly builds heavy-duty Ram pick-ups; Mack Avenue (US), which manufactures the Jeep Grand Cherokee; and Toledo North (US), which builds the new-generation Jeep Wrangler. However, the Jeep Gladiator pick-up saw its production halted at the start of August.

Within its European operations, the situation has been mixed across its former Fiat Chrysler Automobiles (FCA) and Groupe PSA facilities. Former FCA site Melfi, which builds subcompact and compact crossovers, had previously been hit hard, while Cassino and Tychy have both been affected more recently. The pain for former PSA sites has been shared across locations that build vehicles based on both its subcompact CMP and compact- and mid-size EMP2 architectures which are assembled across Western and Central Europe. As well as stoppages and cancelled shifts, some popular models have had to drop overtime and additional work plans. However, it has also sacrificed content in some models to ensure it has semiconductors and components available for other models. Most notably, the outgoing Peugeot 308 reportedly lost its instrument screen, to be replaced by analogue dials.

The CEO of Stellantis, Carlos Tavares, warned in late July that he expects the semiconductor shortage affecting automotive production will drag on into 2022. The senior executive was quoted as stating, "The semiconductor crisis, from everything I see and I'm not sure I can see everything, is going to drag into [20]22 easy because I don't see enough signs that additional production from the Asian sourcing points is going to come to the West in the near future.” He added that the company is taking steps to change the diversity of semiconductors that it is planning to use, but that it still does not have the visibility around this component that it would like. For now, the company plans to continue prioritising building its most profitable vehicles, after losing 700,000 units of production in the first half of the year, according to its second-quarter 2021 financial results.

The German automaker has felt the pressure of the shortage mainly at its sites in Europe. Stoppages have taken place at many of its German facilities, including its core Wolfsburg plant which makes the VW Golf, alongside sites that build its mid-size and large Audi models. Although the company had previously avoided stoppages at certain plants here, its Mosel location, which builds its important MEB-based battery electric vehicles (BEVs), saw a three-day stoppage at the start of the third quarter. The VW Commercial vehicles facility at Poznan (Poland) and the group’s full-size premium and luxury SUV production at Bratislava (Slovakia) have also been affected. The automaker's SEAT-run Martorell (Spain) facility has held back production by reducing the number of shifts, and production was instead halted at various times between June and July. Skoda faces a particular issue at its Mlada Boleslav and Kvasiny plants. Between June and July, the company amassed 50,000 incomplete cars, of which it may be possible to complete 20,000 units during the summer holidays, with reduced production during June and July. Several VW Group sites in the region will implement longer summer shutdowns as well.

Elsewhere, the company has undergone disruptions and stoppages in key regions such as North America and South America mainly across the first and second quarters, and also now emerging in the third quarter. Disruptions have also been noted as taking place in China at its FAW-VW and SAIC-VW JVs during the third quarter, after being hit in the first and second.

In July, VW Group’s head of procurement, Murat Aksel, said at the company’s Annual General Meeting that the organisation had missed out on producing several hundreds of thousands of vehicles in the first half of 2021 due to the ongoing shortage of semiconductors. This was followed the same month by VW Group CFO Arno Antlitz saying, on the announcement of its second-quarter financial results, that the company expects a “more pronounced effect” during the third quarter.

Contrary to the situation that has been felt by some of its other global rivals, Toyota has only suffered a relatively modest disruption from the semiconductor shortage. Some impact to its Japanese operations was felt in the second quarter related to sites that build its Yaris derivatives and the C-HR, and there will also be a short stoppage related to the Corolla in the third quarter. There has been some impact to output in North America, South America, Europe and Mainland China, although this has been to a relatively small proportion of its global footprint.

On the announcement of its first-quarter FY 2021/22 financial results, Toyota has said that it has recorded stable sales and supply despite the challenge of the semiconductor shortage, with volumes close to 2019 levels. It noted that its performance has also been underpinned by its “improvement activities”. It added, “We will continue these activities in the future, but the situation is still unpredictable due to the expansion of COVID-19 in emerging countries, [the] semiconductor shortage, and soaring material prices.” The forecast for consolidated vehicle sales is also unchanged from the May projection, with its volumes seen as reaching 8.7 million units, a gain of 13.8% y/y.

These OEMs are not alone; Honda, Hyundai, and premium automakers BMW Group and Daimler have also been forced to halt production, among others. Details of these and the volume impact can be found in IHS Markit’s assessment of disruptions which is published on a weekly basis and is a cumulative record of events identified. However, as such, not every major OEM is covered.

Following a difficult first half for the OEMs captured in our assessment, the latest intelligence underlines the assessment that disruption from the microchip shortage will continue in the third quarter and this disruption is becoming increasingly significant. An ongoing issue appears to be one of transparency on the availability of microchips. While IHS Markit does not expect the same levels of disruption as in the second quarter, it is now expected to surpass what was seen in the first quarter. The situation in the third quarter is undermined by some delay at Renesas, where having restored manufacturing capacity, it may not be able to fulfil shipments until September. IHS Markit also believes that there is additional volatility due to lockdown measures in Malaysia, where many ‘back-end’ operations are performed, such as packaging and chip testing. As this is more labour-intensive than the wafer fabrication processes, activity is more easily affected by measures that affect workforce participation. In view of these developments, initial thoughts are that the fourth quarter of 2021 may be more exposed to disruption and that this will spill over into the first quarter of 2022. There is also now an expectation that supply may only now stabilise in the second quarter of next year, with recovery efforts now starting only in the second half of 2022.

The updated assessment of semiconductor supply issues for light-vehicle production may be found here.

![[Expert Views] How Tesla Explores its Patent Assets](https://www.mih-ev.org/s3/mih%2Fwp-content%2Fuploads%2F2023%2F01%2FWispro-Expert-Views.png)

Wispro

2023-05-26

MIH Consortium

2023-03-20

MIH Consortium

2023-02-22